NVIDIA Corporation (NASDAQ:NVDA) reported third-quarter financial results on Wednesday after market close.

Here are the key highlights.

Q3 Results: Nvidia reported third-quarter revenue of $57.0 billion, up 62% year-over-year. The revenue total beat a Street consensus estimate of $54.88 billion, according to data from Benzinga Pro.

The company reported earnings per share of $1.30, beating a Street estimate of $1.25.

This marked the 12th straight double beat for Nvidia, with revenue and earnings per share both topping analyst estimates. Revenue also hit a record in the quarter.

Here is a look at the revenue performance by operating business segment.

Data Center segment revenue was a record in the quarter.

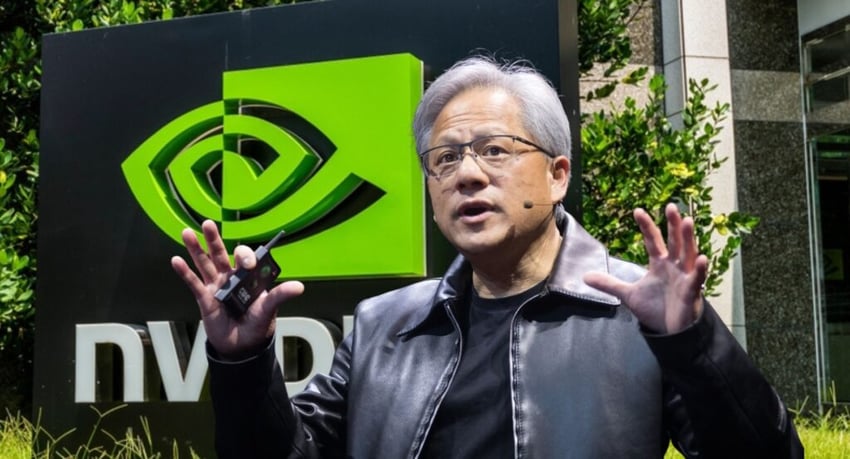

"Blackwell sales are off the charts, and cloud GPUs are sold out," Nvidia CEO Jensen Huang said. "Compute demand keeps accelerating and compounding across training and inference – each growing exponentially."

What's Next: Nvidia is guiding for fourth quarter revenue to be in a range of $63.70 billion to $66.30 billion. The analyst estimate is currently $61.48 billion according to data from Benzinga Pro.

"We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once," Huang said.

NVDA Price Action: Nvidia stock is up 2.8% to $191.81 in after-hours trading on Wednesday, versus a 52-week trading range of $86.63 to $212.19.

A poll of Benzinga users during the "PreMarket Playbook" show Wednesday morning saw traders predict a big move for Nvidia after earnings. Thirty-four percent of viewers said they expect Nvidia to move 5% or more after earnings, which was the leading vote getter.

A move of 0% to 5% was the second-most-voted option at 30%, followed by 24% predicting a 5% drop or flat. Nvidia stock declining 5% or more was the lowest vote total at 12%.

Read Next:

Image created using photos from Shutterstock.

© 2026 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.